Direct Tax MCQ YouTube

8. As per section 271H, where a person fails to file the statement of tax deducted/collected at source i.e. TDS/TCS return on or before the due dates prescribed in this regard, then he shall be liable to pay penalty under section 271H. Maximum penalty that can be levied is ______. A. 1,00,000, but not exceeding the amount of TDS/TCS. B. 2,00,000.

Direct Tax MCQ’s Authore CA Vinod Gupta (H), FCA, ACCA (4th Editions) Buy Online Law

We are sharing with you CA Final Paper 7 Direct Tax MCQs book by CA Ravi Agarwal for MAY 2022 & Nov 2022 Exams. ALL the BEST For Your Upcoming Exams.. CA Final Direct Tax MCQs (Updated for May 22 & Nov 22) By CA Ravi Agarwal Key Features: Covers Integrated Case Study based MCQs All MCQs of Study Material by ICAI Covers all MTPs & RTPs

Direct Tax MCQ Introduction To TaxChapter 1 Tax MCQ's For 2021 Exams CA/CS

MCQ's in Direct tax MCQ CA final for CA Final Exams. Advance Tax and Interest Payable. Online Mock Test in Advance Tax and Interest Payable. Appeals. Online Mock Test in Appeals. Assessment and Re-Assessment. Online Mock Test in Assessment and Re-Assessment. Income Tax Authorities and their powers. Online Mock Test in Income Tax Authorities.

DIRECT TAX PART 2 MCQ PDF

Direct Tax MCQ Questions and Answers Part - 1 Direct Tax MCQ Questions and Answers Part - 2 Direct Tax MCQ Questions and Answers Part - 3 51. Embezzlement of cash by a cashier is. A. a revenue loss. B. a capital loss. C. a casual loss. D. None of these. ANSWER: A 52. Remuneration […]

Direct Tax MCQ Part 1 Junior Accountant clark YouTube

Direct taxes are a fundamental pillar of a nation's fiscal policy, serving as a primary source of revenue for governments worldwide. For individuals, students, and professionals seeking to grasp the intricacies of direct taxation, Multiple Choice Questions (MCQs) offer an invaluable learning and assessment tool.

Direct Tax MCQ Paper for Dec2019 Exam DT MCQ for CS Executive with Answers YouTube

3. Amongst the following _____ is empowered to levy tax on agricultural income. A. Central Government B. State Government C. Commissioner D. President 4. Circulars and Notifications are binding on the A. Central Board of Direct Taxes (CBDT) B. Assessee C. Income Tax Appellate Tribunal (ITAT) D. Income Tax Authorities 5.

VG learning Direct Tax MCQ Old and New Syllabus both CA Final By Vinod Gupta Applicable Nov

Access Professional Tax Experts Covering All Areas Of UK Tax. Try our cost effective Tax advice service for businesses and practices

ICAI Direct Tax MCQ’s For CA Inter May 2023 Exams[150+ Solved] Online Solves

Paper 7 Direct Taxation MCQ : Multiple Choice Questions and Answers January 2, 2022 by Abhimaynu CMA INTERMEDIATE EXAMINATION Multiple Choice Questions and Answers Paper 7 Direct Taxation MCQ Also Read :- Paper 11 Indirect Taxation MCQ Paper 10 Cost & Management Accounting and Financial Management MCQ

Direct Tax MCQ Books at Rs 100/piece MCQ Books in Pune ID 20762883055

11 _____ is a tax that is shifted from one taxpayer to another. Direct Tax Indirect Tax Entry Tax GST Indirect Tax I 12 Indirect Tax is a _____. Regressive tax Progressive tax Tax on tax Value added tax. Regressive tax I 13 Central & excise duty shall be levied in addition to GST on _____. Petroleum Products Alcohol products

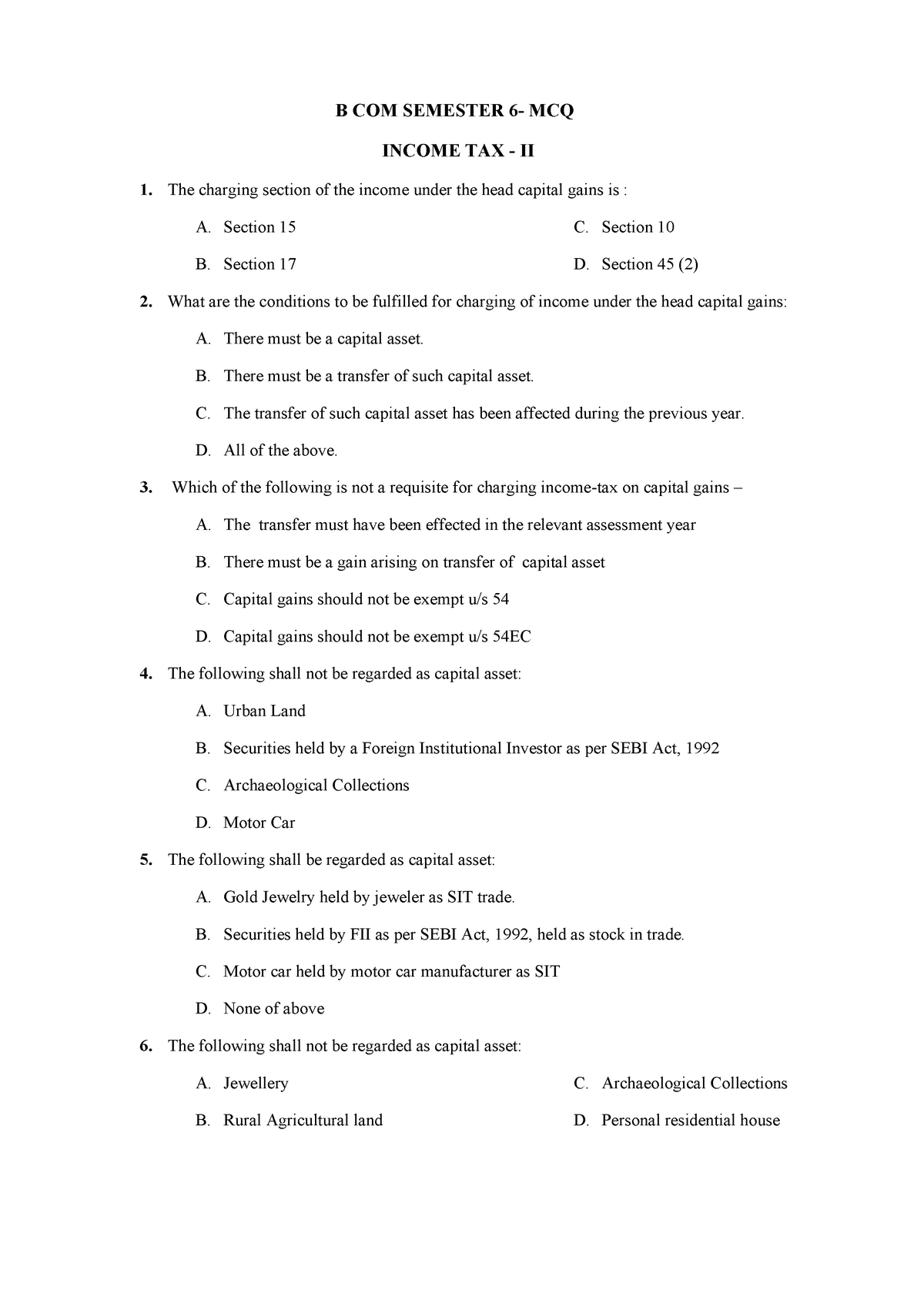

tax II B Com Sem 6 MCQ(Pdf) B COM SEMESTER 6 MCQ TAX II 1. The charging

Direct Tax Quiz Practice Test On: Direct Tax Instructions Select test length i.e. small,medium,large. 1 point for each question. No points will be given for skipped questions. After submission results will be shown instantly with correct choices. If you have any query regarding to a question, refer to discussion page of respective question.

Sem 5 Direct Tax MCQ (Free) Scholarszilla ScholarsZilla

Direct TAX MCQ with detailed explanation for interview, entrance and competitive exams. Explanation are given for understanding. Download Direct TAX MCQ Question Answer PDF Try Direct TAX Mock Test Question No : 1 Sale of agricultural land on 1st April, 1970 is an example of transfer of capital asset. A True False View Answer Discuss

Direct Tax MCQ Direct Tax MCQs UNDER THE HEAD SALARY Q1. Mr. P is a CA is employee of

Solved MCQs for Direct Tax, With PDF download and FREE Mock test. McqMate. Login Register Home Search Login Register Bachelor of Commerce (B Com) Direct Tax Set 1 Save Direct Tax Solved MCQs Take a Test Hide answers 1..

VG learning Direct Tax MCQ CA Final By Vinod Gupta

Let our accredited accountants sort and file your tax return, completely hassle-free. Self Assessment doesn't need to be painful. We file your Tax Returns for you, all online.

Buy Vinod Gupta Direct Tax Book MCQ's at Best Price (2022)

Sign in. DIRECT TAX MCQ.pdf - Google Drive. Sign in

DIRECT TAX PART 2 IMPORTANCE MCQ PDF

Direct Tax MCQ Questions and Answers Part - 2. Direct Tax MCQ Questions and Answers Part - 3. 101. Integration of agricultural income with non agricultural income is not done for A. Individuals B. HUF C. AOP D. firm ANSWER: D 102. Exempted incomes are defined under section A. 15 of income tax Act. B. 18 of income tax Act C. 10 of income tax.

Direct Tax MCQ Marathon For Dec 21 Exam CA/CS/CMA DT MCQ Marathon By CMA Vipul Shah YouTube

The correct answer is Excise tax. Important Points Tax which carry their significance only on paper and have no significance in terms of revenue yield are called paper taxes. Taxes like Gift tax, Estate duty, Wealth tax are paper taxes. Excise duty is a form of tax imposed on goods for their production, licensing, and sale. It is an indirect tax.